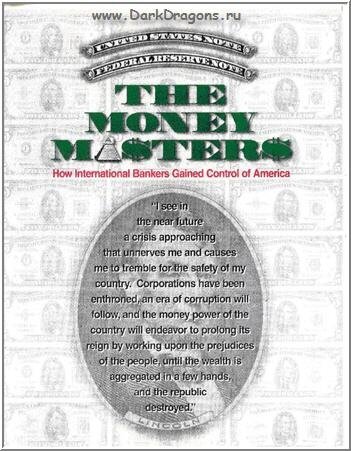

The powers of financial capitalism had a

far-reaching plan, nothing less than to create a world system of

financial control in private hands able to dominate the political system

of each country and the economy of the world as a whole...Their secret

is that they have annexed from governments, monarchies, and republics

the power to create the world's money..." THE MONEY MASTERS is a 3 1/2

hour non-fiction, historical documentary that traces the origins of the

political power structure that rules our nation and the world today. The

modern political power structure has its roots in the hidden

manipulation and accumulation of gold and other forms of money. The

development of fractional reserve banking practices in the 17th century

brought to a cunning sophistication the secret techniques initially used

by goldsmiths fraudulently to accumulate wealth. With the formation of

the privately-owned Bank of England in 1694, the yoke of economic

slavery to a privately-owned "central" bank was first forced upon the

backs of an entire nation, not removed but only made heavier with the

passing of the three centuries to our day. Nation after nation,

including America, has fallen prey to this cabal of international

central bankers. Segments: The Problem; The Money Changers; Roman

Empire; The Goldsmiths of Medieval England; Tally Sticks; The Bank of

England; The Rise of the Rothschilds; The American Revolution; The Bank

of North America; The Constitutional Convention; First Bank of the U.S.;

Napoleon's Rise to Power; Death of the First Bank of the U.S. / War of

1812; Waterloo; Second Bank of the U.S.; Andrew Jackson; Fort Knox;

World Central Bank

Money As Debt

The Secret Of Oz

Monopoly Men

Fiat Empire

Inside Job

The Ascent of Money: A Financial History of The World

Niall Ferguson follows the money to tell

the human story behind the evolution of finance, from its origins in

ancient Mesopotamia to the latest upheavals on what he calls Planet

Finance.

http://www.niallferguson.com

Bread, cash, dosh, dough, loot, lucre, moolah, readies, the wherewithal: Call it what you like, it matters. To Christians, love of it is the root of all evil. To generals, it's the sinews of war. To revolutionaries, it's the chains of labor. But in The Ascent of Money, Niall Ferguson shows that finance is in fact the foundation of human progress. What's more, he reveals financial history as the essential backstory behind all history.

Through Ferguson's expert lens familiar historical landmarks appear in a new and sharper financial focus. Suddenly, the civilization of the Renaissance looks very different: a boom in the market for art and architecture made possible when Italian bankers adopted Arabic mathematics. The rise of the Dutch republic is reinterpreted as the triumph of the world's first modern bond market over insolvent Habsburg absolutism. And the origins of the French Revolution are traced back to a stock market bubble caused by a convicted Scot murderer.

With the clarity and verve for which he is known, Ferguson elucidates key financial institutions and concepts by showing where they came from. What is money? What do banks do? What's the difference between a stock and a bond? Why buy insurance or real estate? And what exactly does a hedge fund do?

This is history for the present. Ferguson travels to post-Katrina New Orleans to ask why the free market can't provide adequate protection against catastrophe. He delves into the origins of the subprime mortgage crisis.

Perhaps most important, The Ascent of Money documents how a new financial revolution is propelling the world's biggest countries, India and China, from poverty to wealth in the space of a single generation—an economic transformation unprecedented in human history.

Yet the central lesson of the financial history is that sooner or later every bubble bursts—sooner or later the bearish sellers outnumber the bullish buyers, sooner or later greed flips into fear. And that's why, whether you're scraping by or rolling in it, there's never been a better time to understand the ascent of money.

http://www.niallferguson.com

Bread, cash, dosh, dough, loot, lucre, moolah, readies, the wherewithal: Call it what you like, it matters. To Christians, love of it is the root of all evil. To generals, it's the sinews of war. To revolutionaries, it's the chains of labor. But in The Ascent of Money, Niall Ferguson shows that finance is in fact the foundation of human progress. What's more, he reveals financial history as the essential backstory behind all history.

Through Ferguson's expert lens familiar historical landmarks appear in a new and sharper financial focus. Suddenly, the civilization of the Renaissance looks very different: a boom in the market for art and architecture made possible when Italian bankers adopted Arabic mathematics. The rise of the Dutch republic is reinterpreted as the triumph of the world's first modern bond market over insolvent Habsburg absolutism. And the origins of the French Revolution are traced back to a stock market bubble caused by a convicted Scot murderer.

With the clarity and verve for which he is known, Ferguson elucidates key financial institutions and concepts by showing where they came from. What is money? What do banks do? What's the difference between a stock and a bond? Why buy insurance or real estate? And what exactly does a hedge fund do?

This is history for the present. Ferguson travels to post-Katrina New Orleans to ask why the free market can't provide adequate protection against catastrophe. He delves into the origins of the subprime mortgage crisis.

Perhaps most important, The Ascent of Money documents how a new financial revolution is propelling the world's biggest countries, India and China, from poverty to wealth in the space of a single generation—an economic transformation unprecedented in human history.

Yet the central lesson of the financial history is that sooner or later every bubble bursts—sooner or later the bearish sellers outnumber the bullish buyers, sooner or later greed flips into fear. And that's why, whether you're scraping by or rolling in it, there's never been a better time to understand the ascent of money.

The Chicago Sessions

Widely known philosopher and University

of Chicago Law School professor Martha Nussbaum explores the ethical

implications of the financial crisis during three sessions with a group

of ten talented law and philosophy students. The grounds of the

University of Chicago provide a compelling arena, since it is here that

both economist Milton Friedman, staunch promoter of free market

capitalism, and president Barack Obama, lectured. Together with some of

America's brightest young minds, Backlight explores the ethical

principles that might guide our post-crisis society. Examples of crisis

related issues discussed during the sessions are: mortgage lending

practices, foreclosures, bail outs and CEO pay. The students will test

their ideas both on eminent professors from the University of Chicago

and on field experts. The discussion is fueled and illustrated by case

stories that the students themselves provided. Examples of crisis

related issues discussed during the sessions are: mortgage lending

practices, foreclosures, bail outs and CEO pay. The students will test

their ideas both on eminent professors from the University of Chicago

and on field experts. The discussion is fueled and illustrated by case

stories that the students themselves provided. Most of what happened on

the financial markets in the ascent to the credit crisis was perfectly

legal, but is it, given the outcome, also just? Looking at the USA

today, we see the destructive consequences the credit crisis has had and

still has on fundamental human needs, such as shelter, income and

education. Citizens see their livelihoods being threatened, while the

financial industry got their bailout. What is going on? Did we put too

much faith in free markets when it comes to delivering just outcomes?

Does the crisis reveal a need to rethink some of the foundational

principles that define our society? These cases show how the financial

crisis really affects the people of Chicago and in one example shows the

consequences of the foreclosures in a neighborhood not far from the

university and president Obama's home.

The Food Speculator

Assuming the role of a speculator,

director Kees Brouwer tries to find out whether he is merely taking

advantage of the opportunity offered to investors by the food scarcity,

or that, through this abstract world of financial products, he is

drastically interfering in poor people's lives.

Director: Kees Brouwer & co-director Maren Merckx

Producer: VPRO Backlight

Increasing

food prices are increasingly causing unrest in the world. It was no

coincidence that when the Arab Spring first began Tunisian protesters

attacked the order police with baguettes. Is there just not enough food

for so many people, or are the price increases caused by speculators,

looking for quick profits? Backlight tries to find an answer by doing a

little food speculation of its own. A quest that leads us to places

including the streets of Tunisia and the Chicago Stock Exchange

Money & Speed: Inside the Black Box

Money & Speed: Inside the Black Box

is a thriller based on actual events that takes you to the heart of our

automated world. Based on interviews with those directly involved and

data visualizations up to the millisecond, it reconstructs the flash

crash of May 6th 2010: the fastest and deepest U.S. stock market plunge

ever.

Quants: The Alchemists of Wall Street

Quants are the math wizards and computer

programmers in the engine room of our global financial system who

designed the financial products that almost crashed Wall st. The credit

crunch has shown how the global financial system has become increasingly

dependent on mathematical models trying to quantify human (economic)

behaviour. Now the quants are at the heart of yet another technological

revolution in finance: trading at the speed of light.

What are the risks of treating the economy and its markets as a complex machine? Will we be able to keep control of this model-based financial system, or have we created a monster?

A story about greed, fear and randomness from the insides of Wall Street.

What are the risks of treating the economy and its markets as a complex machine? Will we be able to keep control of this model-based financial system, or have we created a monster?

A story about greed, fear and randomness from the insides of Wall Street.

97% Owned - Economic Truth

97% owned present serious research and

verifiable evidence on our economic and financial system. This is the

first documentary to tackle this issue from a UK-perspective and

explains the inner workings of Central Banks and the Money creation

process.

When money drives almost all activity on the planet, it's essential that we understand it. Yet simple questions often get overlooked, questions like; where does money come from? Who creates it? Who decides how it gets used? And what does this mean for the millions of ordinary people who suffer when the monetary, and financial system, breaks down?

Produced by Queuepolitely and featuring Ben Dyson of Positive Money, Josh Ryan-Collins of The New Economics Foundation, Ann Pettifor, the "HBOS Whistleblower" Paul Moore, Simon Dixon of Bank to the Future and Nick Dearden from the Jubliee Debt Campaign.

When money drives almost all activity on the planet, it's essential that we understand it. Yet simple questions often get overlooked, questions like; where does money come from? Who creates it? Who decides how it gets used? And what does this mean for the millions of ordinary people who suffer when the monetary, and financial system, breaks down?

Produced by Queuepolitely and featuring Ben Dyson of Positive Money, Josh Ryan-Collins of The New Economics Foundation, Ann Pettifor, the "HBOS Whistleblower" Paul Moore, Simon Dixon of Bank to the Future and Nick Dearden from the Jubliee Debt Campaign.

- In Time is a 2011 dystopian science fiction action film

In the year 2169, humanity has been genetically engineered to stop aging at 25 and to be born with a digital clock, bearing a year worth of time, on their forearm . At the age of 25 the clock begins counting down, when it reaches zero that person dies. Time has been turned into the universal currency, giving time for products or services just by body contact, as well as transferring to others. A person can no longer die of old age and can only die by "timing out" (running out of time), having one's clock "cleaned" (murder by someone taking all their time), or simply by being reckless that age is not a factor in that reason (e.g. getting shot, overdosing, etc.). The country is divided into time zones, based on the wealth of its population; the film focuses on two time zones. Dayton, a ghetto zone whose inhabitants barely have a day if they don't work in the local factory, is one of the poorest with people being indifferent to the timed-out bodies on the streets. The other zone is New Greenwich, the wealthiest zone where the wealthy enjoy the benefits of their immortality and wealth but are constantly surrounded by body guards and are very conscious about their actions to prevent non-age related deaths.MoneyThe so-called "root of all evil" took its name from a title of Rome's

Great Mother, Juno Moneta (Juno the Admonisher), whose Capitoline

temple included the Roman mint. Silver and gold coins manufactured

there were valuable not only by reason of their precious metal but

also by the blessing of the Goddess herself, which could effect good

fortune and healing magic. Later popes carried on the pagan tradition

by blessing Christian amulets and holy medals which were also used

in trade, like money.1

The attendant spirit of Juno Moneta was the erotic Cupid,

corresponding to the Greeks' Eros, who was both child and companion

of Aphrodite. Thus, "cupidity" used to mean erotic desire, but in ·

Christian times its meaning was changed to greed for money.From Barbara Walker's Women's Encyclopedia of Myths and SecretsThe Moneyless Manifesto by Mark Boyle

-

the brain of a banker

partially in dutch

Inside the Psyche of the 1% -- Many Actually Believe Their Ideology of Greed Makes for a Better World

November 4, 2013

|

Do

the rich and super-rich tend to be psychopaths, devoid of guilt or

shame? Are the 1% lacking in compassion? Does their endless accumulation

of possessions actually bring them little to no happiness? To each of

these, the answer is “yes”—but a very qualified “yes” with lots of

subtleties. Even more important is what these issues suggest for

building a society which does not ravage the last remnants of wilderness

and rush headlong into a climate change tipping point.

Strange concepts of psychopathy

The

word “psychopath” often elicits an image of a deranged murderer.

Despite Alfred Hitchcock’s chair-gripping “Psycho,” stabbing victims in

the shower is not a typical activity of psychopaths. They are more often

con artists who end up in jail after cheating their victims. Classic

definitions of psychopathy include features such as superficial charm,

anti-social behavior, unreliability, lack of remorse or shame,

above-average intelligence, absence of nervousness, and untruthfulness

and insincerity. [1]

Most

of those in the mental health industry sternly observe that a strict

set of consistent rewards and consequences is the only treatment that

works with psychopaths. But they admit that even this treatment might

not work too well. Progressives may dismiss observations by

psychologists because the field tends to explore a behavioral pattern as

it exists in a certain Western culture at a given point in history and

then imagine that it characterizes all people at all times. Psychology

has a long tradition of bending to current race, gender and sexual

orientation biases. Its class bias is reflected by the dominant

portrayal of psychopathy.

Consider

what William H. Reid, MD, from the Department of Psychiatry at the

University of Texas Health Sciences Center in San Antonio writes about

psychopaths:

I have no wish to dehumanize people when I say that those who purposely endanger others in our streets, parks, and schools, even our homes, are qualitatively different from the rest of us. I care less and less about why they’re not the same as the rest of us; the enemy is at our door…There is no (reasonable) ethic which requires that we treat him as other adults; indeed, to do so is foolish. [2]

Reid

cautions his readers: “We must stop identifying with the chronic

criminal, and stop allowing him to manipulate our misplaced guilt about

treating him as he is: qualitatively different from the rest of us. [3]

The

author insists that good people must have the stamina to do what is

necessary to protect themselves from the psychopathic criminal:

…life is full of situations in which we need to do something distasteful…Most of us agree that we need to slaughter animals from time to time. We do it as humanely as possible, but we get it done…We also agree that some public health needs are important enough to require the suspension of some rights of people who have not been convicted of any crime…” [4]

Reid

chides those who recoil at the thought of suspending rights: “While we

have been interminably discussing this weighty issue, the psychopaths,

who don’t trouble themselves with contemplations, have been gaining

ground.” [5]

Where

did these insights appear? Not in a transcript of a Rush Limbaugh

interview. Not in an Ayn Rand novel. Not from someone fondly reminiscing

of Ronald Reagan.

These words are excerpted from an essay in the scholarly volume Psychopathy: Anti-Social, Criminal and Violent Behavior. The

text is predominantly a collection of reports and syntheses under

academic headings of “Typologies,” “Etiology,” “Comorbidity” and

“Treatment.” The portions quoted illustrate that intense hostility

directed towards victims of the criminal justice system is within the

acceptable continuum of published academic thought on psychopathy.

A demon with two horns

The

words from Reid reflect what is called the “categorical view.” It

maintains that the difference between “psychopaths” and “normals” is as

clear-cut as the difference between left-handedness and

right-handedness.

A

contrasting perspective, with a large amount of research to back it up,

is the “dimensional view.” It regards psychopathy and other

“personality disorders” as exaggerated expressions of normal behavior.

Just as we are all more or less compassionate, we all have the ability

to be manipulative and deceitful. We act so when we think that

circumstances warrant it.

Geen opmerkingen:

Een reactie posten